IFTA Managerby TMS Digital

IFTA Reporting Made Easy

No more paperwork! Directly import truck ELD data

and Fuel Card purchases for IFTA auto-reporting.

30 DAY FREE TRIAL

The Way IFTA Reporting Should Be

An affordable and easy-to-use fuel tax calculator that eliminates the administrative burden of collecting state mileage and fuel receipts to keep your business truckin'. Ensure your Interstate Fuel Tax Agreement (IFTA) filing's are done right the first time, with IFTA Manager by TMS Digital.

IFTA made easy with imported ELD and Fuel Card trip data.

Take the pain of fuel tax reporting

IFTA Manager’s user-friendly fuel tax reporting software makes it easy for transportation companies of any size to streamline routine processes and stay compliant

Import Fuel Card Data Automatically

IFTA Manager's custom API integration with fuel cards reduces manual processes and the risk of clerical errors.

Track Mileage Easily with Trip Data

Instantly upload ELD trip records or quickly enter missing odometer readings manually. Customize your Trip Data dashboard and filter summaries by date, mileage, state, driver, or vehicle.

Data Validation Helps to Map Missing Miles & Uncommitted Fuel

Automatic IFTA Tax with One Click

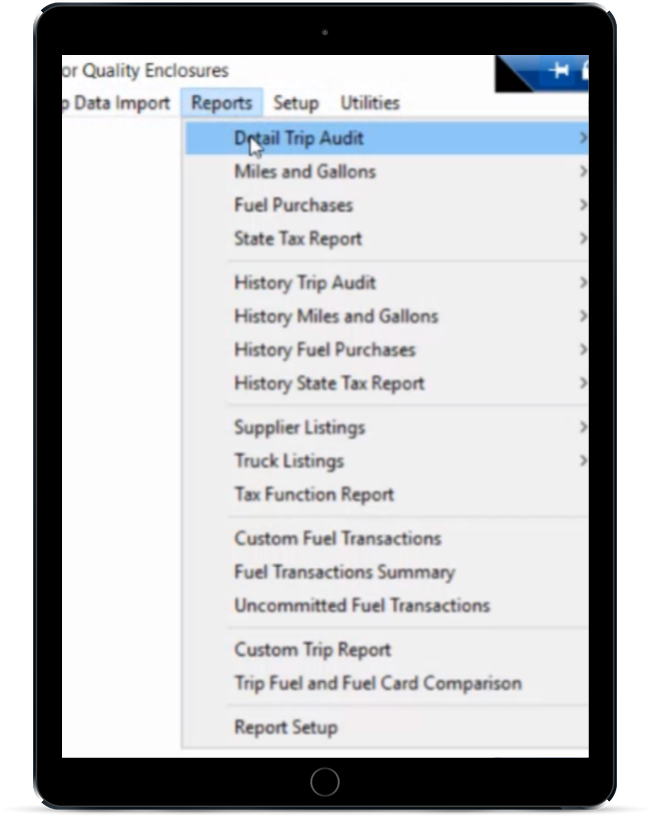

IFTA software for fuel tax reporting automatically calculates the distance traveled and fuel purchased by jurisdiction. You can view trip reports in detail or filter summaries by date or vehicle type.